Property Management is the Key to Driving Fund Performance for SFR Investors

In the highly competitive world of institutional single-family residential investing, creating value and driving performance can be a challenging undertaking. Factors such as local real estate market conditions, acquisition costs, market competition, rental rates, and so on impact how a portfolio of single-family rental homes performs.

However, the most significant contributing factor to portfolio performance for institutional SFR investors is the operational effectiveness and efficiency of their property management systems.

Institutional SFR groups have approached managing their portfolios by outsourcing property management to third-party local managers, bringing property management ‘in-house,' and various combinations of outsourcing and in-house management.

The primary purpose of bringing property management ‘in-house’ is to manage the rental portfolio more efficiently and more profitably than a 3rd party manager. For the purposes of discussion, this article will focus mainly on ‘in-house’ property management systems, as they seem to cause the most heartburn for SFR institutions.

As many institutional investors have learned, managing hundreds or thousands of properties can be significantly more challenging than it appears from the outside. Why is that? Well, property management is a very complicated assembly line, with multiple moving parts that interact across the entire lifecycle of a property.

Moving a property through the full lifecycle is like building a ten-story building on a treadmill: you are working with layers of complexity, while the entire building is moving. The ripple effects of a flaw in your process, property management software, or human capital can be felt all the way into the performance of the rental portfolio itself.

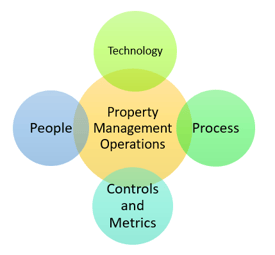

When we look at the components of property management operations, they ultimately fall into four categories: property management software (the technology element), processes, people, and controls and metrics. Let’s take a closer look at how these areas can impact fund performance.

When we look at the components of property management operations, they ultimately fall into four categories: property management software (the technology element), processes, people, and controls and metrics. Let’s take a closer look at how these areas can impact fund performance.

TECHNOLOGY ARCHITECTURE

At the heart of property management operations is the technology utilized to run your entire setup. Your property management software is the glue that holds the other components together.

Unfortunately, in the world of SFR institutional management, it is the weakest link. Property management on the national, institutional level is a relatively new industry. While strides have been made in technology, the industry is still in its infancy. Holistic, integrated software solutions are still an elusive dream.

The result is a rat’s nest of technology and software solutions that are often duct-taped together rather than operating as a successful property management system. This often includes tracking complicated processes on (Gasp!) spreadsheets. Ultimately, this approach leads to duplicated work, double entry into multiple systems, dropped balls, poor customer service, costly mistakes, and negative impacts on fund performance.

The key to building an effective technology architecture is to reduce the amount of systems when possible without sacrificing too many desirable features. There is an ongoing debate between choosing standalone ‘best in class’ solutions that are rigged together (the duct-tape method) and choosing integrated property management software solutions.

The latter cover more operational processes inside of a single framework. Given that property management alreadt involves so many moving parts, the bias should be towards integration over standalone ‘best in class’ options.

PROCESS (DEPARTMENT WORKFLOWS)

PROCESS (DEPARTMENT WORKFLOWS)

Departmental workflows go hand in hand with the technology architecture utilized by an institutional property manager.

Most institutions have some level of documented property management systems, but often there are some missing components.

First, does the property management software you use reinforce those processes? A workflow often makes sense theoretically, but employees can often operate ‘off the grid,' doing an end run around established procedures. When procedures are not followed it causes chaos, inaccurate reporting, and miscommunication.

Second, workflows often do not adequately contemplate interdepartmental handoffs or how it may impact the property later in its lifecycle. Far too often, a workflow is developed in a vacuum without taking into consideration its broader implications and how the application meets the reality of how your managers work. By integrating technology controls and ensuring your property management systems are developed with the entire lifecycle in mind, a property management division can become a well-oiled machine.

PEOPLE

Clearly defined roles, responsibility, and accountability are critical to a successful property management systems. It may seem like a no-brainer but is particularly challenging in property management. Take the move-out process for example. This process involves inspectors, the leasing team, the make-ready department, outside vendors, field techs, and accounting personnel.

Each person must work in harmony with the others involved to turn the property quickly and avoid a long vacancy. When defining roles and responsibilities, it is essential to take a bird’s eye view of your operation to ensure that the role interacts appropriately with the rest of the people involved in each process.

CONTROLS AND METRICS

Controls and metrics—simple, right? Well, not so fast. When an institutional investor brings property management in-house, they tend to look at the property management operations through the lens of the funds. While this makes sense to an extent, it isn’t the entire picture.

Often, looking at metrics in 3 buckets makes a bit more sense.

- Bucket 1: Fund Performance Metrics.

- Bucket 2: Property Management Operational Metrics.

- Bucket 3: Property Management Business Metrics.

The reason for this is that the operations of the property manager drive the fund performance.

- Bucket 1 is the resulting fund performance.

- Bucket 2 is the daily, weekly, and monthly reporting tools to manage the property manager daily.

- Bucket 3 is the financial and operational business metrics of the property manager.

KEY TAKEAWAYS

As many single-family residential institutional investors know, managing thousands (and even tens of thousands) of properties can be extremely challenging.

In the ever-evolving property management world, it takes a vigilant effort to continue to drive fund performance. Here are a few take away items:

- Treat the property management division as a standalone business and incentivize its management as such.

- Everything impacts everything: property management is an intertwined web. When changing something operationally, make sure you contemplate how it affects the rest of the property lifecycle.

- Property management is a ‘Help Desk’ business. Build a world-class help desk that happens to do property management, and you will have yourself a world-class property management division (and world-class fund performance).

- Property management automation is a crucial component to the success of everything mentioned here.

- Don’t settle for ‘industry standard’. This industry in its current form is very young. If the ‘industry standard’ doesn’t seem to make sense, it probably doesn’t. The early pioneers of institutional SFR investing made the best decisions with the information they had at the time. Much has evolved and changed over the last decade, so don’t be afraid to question the ‘industry standard’.

- Don’t fear your tenants: treat them well and be fair. However, it can be tempting to make occupancy a higher priority than anything else. Don’t get sucked into the trap of letting tenants take advantage of lax standards because you are so focused on keeping them in the house.

- Have a strong bias towards consolidating technology. While it is not realistic to have every technological need met in one system, try to use as few software tools as possible. Integration often trumps best in class when it comes to property management software solutions.

- Do not be tempted to make poor operational decisions based on the pressure to meet the next quarter’s fund performance goals. You may do severe long-term damage to your property management operations.

- Remember that the reason for bringing property management systems 'in-house' is to perform better than if you were to outsource it. Decisions you make should be to that ultimate end.

- The funds/portfolio is your client. The property management division should view this relationship just as a 3rd party property manager does. It is a client relationship that should not be taken for granted.

For SFR institutional investors, operating as a property manager brings a myriad of challenges. However, a well-run property management division can drive superior returns year after year. It takes an ever-watchful eye on operations and an investment in property management automation, but the rewards are well worth the effort.

By: Michael Park, JD

By: Michael Park, JD

Michael Park is the Managing Partner at Geekly Media. After managing the operations, sales, and metrics for thousands of residential properties across the nation, Michael advises property management companies on how to grow and manage their business. With more than 18 years of industry experience, Michael helps companies streamline processes through property management automation, develop powerful growth strategies, and build more profitable property management companies.

Michael is a seasoned real estate professional, executive-level manager, and entrepreneur. Michael has been involved in thousands of residential real estate transactions while working in property management, as a partner at a large, multi-office real estate law firm, a regional title insurance executive, and as founder and owner of a successful real estate law firm. Michael has been featured on Fox 4, KLIF 570 AM, KRLD 1080 AM, Trulia.com, Unlock Your Wealth Radio, and numerous news articles.